Vinaship's (VNA) profit in the second quarter of 2025 decreased by 99.1%

Posted on: 23/07/2025

In the second quarter of 2025, Vinaship recorded revenue of VND 192.5 billion, up 12.7% over the same period, and recorded profit after tax of VND 0.24 billion, down 99.1% over the same period. In particular, gross profit margin decreased from 6.2% to 4.3%.

During the period, although revenue increased, due to the narrowing gross profit margin, Vinaship's gross profit still decreased by 22.1% compared to the same period, equivalent to a decrease of VND 2.33 billion, to VND 8.22 billion; financial revenue decreased by 22.9%, equivalent to a decrease of VND 1.2 billion, to VND 4.05 billion; financial expenses increased by 13.17 times, equivalent to an increase of VND 2.37 billion, to VND 2.55 billion; sales and business management expenses decreased slightly by 1.6%, equivalent to a decrease of VND 0.15 billion, to VND 9.35 billion.

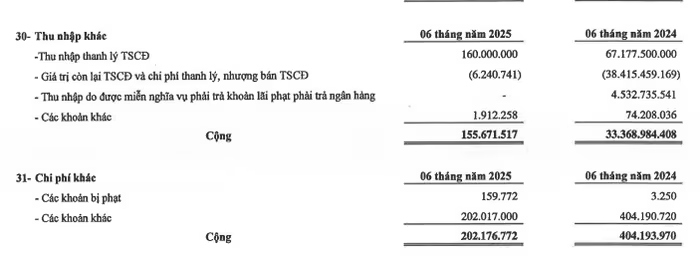

Notably, in the second quarter, other profits recorded a negative 0.04 billion VND compared to the same period last year with a profit of 28.4 billion VND, a decrease of 28.44 billion VND.

Vinaship added that the Vinaship dry cargo fleet still mainly operates on the Northeast and Southeast Asia routes with the combined voyage charter method and the main commodities are cement, clinker, coal, rice, and fertilizer. In the second quarter, the exploitation efficiency was affected by unfavorable market factors, unstable cargo sources, some risks in ship operations, incidents of ship damage and revenue loss, and many costs. These factors caused the production and business efficiency of the Vinaship fleet in the second quarter of 2025 to decrease compared to the same period.

Vinaship will lose revenue from liquidating fixed assets in the first half of 2025.

In the first half of 2025, Vinaship recorded revenue of VND 319.87 billion, up 4.9% over the same period, and profit after tax of VND 0.33 billion, down 98.8% over the same period last year.

It is known that in 2025, Vinaship plans to have revenue of 745 billion VND, with pre-tax profit expected to be 117.5 billion VND.

Thus, ending the first half of 2025 with pre-tax profit reaching VND 0.44 billion, Vinaship has only completed 0.4% of the yearly plan.

In addition to the decline in business, in the first half of 2025, Vinaship also recorded a negative operating cash flow of VND18.3 billion compared to a positive VND4.3 billion in the same period. In addition, in the same period, investment cash flow was positive VND51.4 billion and financial cash flow recorded a negative VND10.45 billion.

In terms of asset size, by the end of the second quarter, Vinaship's total assets decreased by 4.4% compared to the beginning of the year, equivalent to a decrease of VND 35.47 billion, to VND 773.39 billion. Of which, the main assets recorded VND 394.8 billion in fixed assets, accounting for 51% of total assets; VND 241.7 billion in cash and short-term financial investments, accounting for 31.3% of total assets and other items.

Notably, on July 15, Vinaship closed the list of shareholders to pay 2024 cash dividends and will also conduct a written shareholder consultation. In particular, the Company submitted to shareholders for approval a plan to sell 1 ship in 2025, the Vinaship Sea with a tonnage of 27,841 DWT, built in 1998 in Japan and the liquidation value has not been announced.

Closing the trading session on July 22, VNA shares closed at a reference price of VND 19,000/share, equivalent to a capitalization of VND 646 billion.